arizona estate tax return

Federal law eliminated the state death tax credit effective January 1 2005. But that doesnt leave you exempt from a number of other necessary tax filings like the following.

With this document the trust can deduct interest it distributes to beneficiaries from its overall taxable income.

. Learn Arizona tax rates for property sales tax to estimate how much youll pay on your 2021 tax return. If an estate is worth 15 million 36 million is taxed at 40 percent. The arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. About Arizona Estate or Trust Income Tax Payment Voucher. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

We complete over 600 trust returns Form 1041 on behalf of clients every year and we do 5 to 10 estate tax returns Form 706 annually. 20 rows Arizona Fiduciary Income Tax Return Income tax return filed by a. Monroe Room 610 Phoenix AZ 85007.

Please review the information. Trump on December 22 2017 raised the federal estate tax exemption to 11180 million per person which. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

Thank you for your inquiry. Open it with online editor and begin altering. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

14 rows Arizona Fiduciary Income Tax Return. Form is used by a Fiduciary who electronically files an estate or trusts tax return Form 141AZ and is separately mailing payment for taxes not remitted with the tax form when filed. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

The estate has a beneficiary that is not an Arizona resident. We cannot provide a status at this time. Additionally the trust must file a Form 1041 which reports income capital gains deductions and losses.

All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax. 2017 Estate and Gift Tax Law Changes. The arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

IRAs and other retirement accounts can create different tax issues. Change the template with exclusive fillable fields. But there are states that do impose a state-level estate tax.

Please allow more. IRS Form 56 to prove you are the executor of the estate. The estate and gift tax exclusion amounts were increased to 5450000.

Arizona Estate or Trust Income Tax Payment Voucher. You would pay 95000 10 in inheritance taxes. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now.

The arizona estate tax was repealed in 2006. You would receive 950000. 31 2021 can be prepared and e-Filed now along with your Federal or IRS Income Tax Return or you can learn how to complete and file only an AZ state return.

The annual exclusion for gift taxes remains at 14000. 2016 Estate and Gift Tax Law. Concerned parties names addresses and phone numbers etc.

The Arizona tax filing and tax payment deadline is April 18 2022. The estate has a beneficiary that is not an Arizona resident. If it is incorrect click New Search.

Find IRS or Federal Tax Return deadline details. Residents and nonresidents owning property there can rejoice. If needed the personal representative should request the tax release certificate when filing the final income tax return for the estate.

Even though Arizona does not have its own estate tax the federal government still imposes its own tax. The exemption trust is the most common of these tools and it requires additional oversight from trustees. Put the particular date and place your e-signature.

The annual exclusion for gift taxes remains at 14000. For estates of resident and nonresident decedents with date of death on or after January 1 1980. At this time Arizona residents with property only in Arizona only need to concern themselves with the federal estate tax.

Estate Tax Unit Arizona Department of Revenue 1600 West Monroe Room 520 Phoenix AZ 85007-2650. Any forms proving income earned including W-2s and 1099s. Complete and mail to.

As of 2015 individuals with estates under 543 million and married. Arizona state income tax rates range from 259 to 450. Because Arizona conforms to the federal law there is.

If you own property in those states or have heirs who live in one of those states your estate and their inheritance may be subject to taxation. Arizona Estate Tax. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

This exemption rate is subject to change due to inflation. Fill in the empty areas. The estate and gift tax exclusion amounts were increased to 5490000.

First Arizona does not have its own estate tax. If you have submitted your return 6 weeks ago or less this update means your return is still pending and has not been processed. 2018 Estate and Gift Tax Law Changes.

If you own property in other states some states have their estate or inheritance tax. Arizona trustees must file a federal estate tax return for any trust valued at more than one million dollars. Many times however those with large estates have used tools to effectively reduce or eliminate the estate tax.

Arizona Department of Revenue. 13 things that you may not know about preparing a federal estate tax return. The value of the estate exceeds 20000 at time of death.

The Tax Cuts and Job Act signed into law by President Donald J. Arizona Department of Revenue 1600 W. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

If it is incorrect click New Search. Even though Arizona does not have its own estate tax the federal government still imposes its own tax. Arizona Estate Tax Return.

Your Arizona State Income Taxes for Tax Year 2021 January 1 - Dec. To file taxes for the deceased youll need the following forms. The certificate request should be mailed to.

IRS Form 1310 if the deceased will receive a refund this. The estate would pay 50000 5 in estate taxes. While the estate tax is not an inheritance tax as it is paid to the federal government by the estate and not the heirs such a tax can reduce the amount of money heirs receive.

There are no inheritance taxes or estate taxes in Arizona. George karibjanian franklin karibjanian. The current federal estate tax is currently around 40.

Click here to view other state estate and inheritance taxes. Arizona Estate Tax Return. It may take 8-10 weeks to process.

31 2021 can be prepared and e-Filed now along with your Federal or IRS Income Tax Return or you can learn how to complete and file only an AZ state return. The estate and gift tax exclusion amounts were increased to 5490000. Find the Arizona Inheritance Tax Waiver Form you require.

2016 Estate and Gift Tax Law Changes. As of 2006 Arizona no longer levies an estate tax. Click Done following twice-checking everything.

Several of our CPAs are members of the Southern Arizona Estate Planning Council and the Central Arizona Estate Planning Council and attend national estate planning forums. Fees paid to executors and administrative costs incurred in the settling of the estate are also deductible.

Complete Your 2021 Arizona And Irs Taxes Now On Efile Com

Arizona Estate Tax Everything You Need To Know Smartasset

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Caring Transitions Of Southern Arizona Logo Online Estate Sales Caring Estate Sale

Arizona Estate Tax Everything You Need To Know Smartasset

Arizona Retirement Tax Friendliness Smartasset

Will And Testament Template Free Printable Documents Last Will And Testament Will And Testament Estate Planning Checklist

Arizona Estate Tax Everything You Need To Know Smartasset

Gain An Understanding Of The Different Designs Of Trusts Centered Around Dynasty Trust Dynasty Trusts Are Incre Estate Planning Continuing Education Estate Tax

Arizona State Taxes 2022 Tax Season Forbes Advisor

Hitting The Market Thursday Want To See It Today Move In Ready New Carpet Call Me Text Me 602 758 7135 New Carpet Arizona Real Estate Home Buying

Average Tax Refund Climbs To 3 034 So Far This Year Tax Refund Income Tax Return Income Tax

What S The Arizona Tax Rate Credit Karma Tax

Property Taxes 101 Redfin Estate Tax Property Tax Tax Deductions

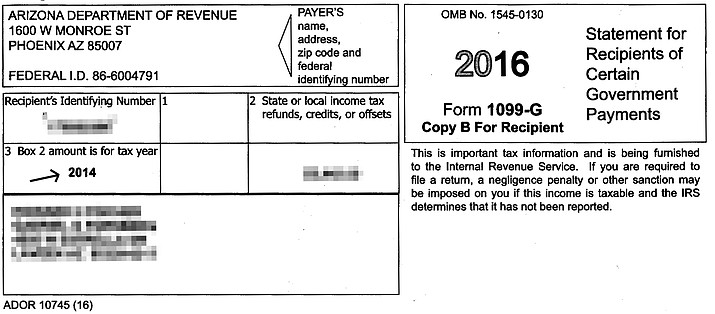

Hold Up On Doing Your Taxes Arizona Tax Form 1099 G Is Flawed The Verde Independent Cottonwood Az