coinbase pro taxes uk

Connect your account by importing your data through the method discussed below. Just like with Coinbase you can deposit GBP directly into Coinbase Pro quickly and for free with a UK bank transfer.

Germany Crypto Tax Guide 2022 Kryptowahrung Steuer 2022 Koinly

In the Currency Type field select GBP.

. Coinbase exports a complete Transaction History file to all users. However Coinbase has partnered with some awesome crypto tax apps that can take your Coinbase transaction report and use it to generate a tax report for Coinbase. Its important to note.

When they send out your tax info will it all be in one document or. In the Deposit GBP menu select the Bank Account tab select From then select the Add Account link. You can generate your gains losses and income tax reports from your Coinbase investing activity by connecting your account with CoinLedger.

Best CoinbaseCoinbase Pro tax calculators CryptoTraderTax. If youve used other Coinbase products like Pro or Wallet transacted on DEXes or DeFi applications or traded NFTs it may not be possible to. If you need professional support ZenLedger can introduce you to a crypto tax professional eg a tax attorney CPA or Enrolled Agent to get your crypto and non-crypto taxes done quickly and accurately using the smartest tax strategies.

I brought about half of my crypto with Coinbase transferred it over to Coinbase Pro and then bought more of that crypto with Coinbase Pro and then ultimately sold that crypto. The software also calculates your gains and losses. As first reported by decrypt the popular crypto exchange emailed some.

12570 Personal Income Tax Allowance. The service will also help out with transactions outside of. If you use Coinbase you can sign in to find reports on your gains losses and transactions.

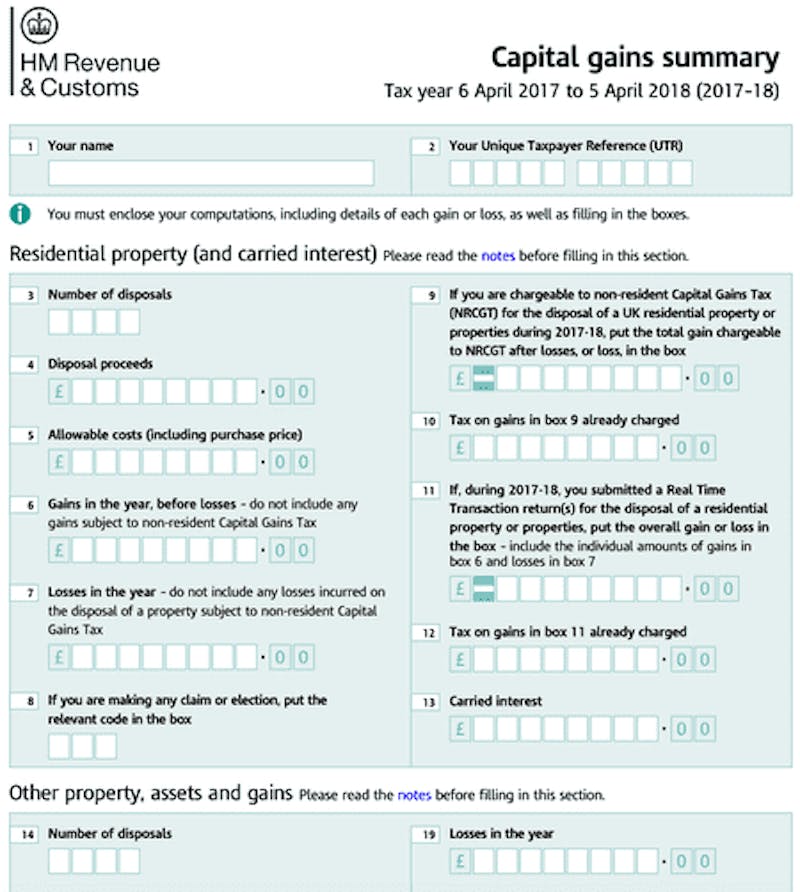

Coinbase Pro is one of the most popular crypto exchanges in the UK. Assets held over a year or more are subject to long-term capital gains tax while assets bought and sold within a year are subject to short term capital gains rates. Tax is also paid at a different rate depending on how long the assets are held.

Within CoinLedger click the Add Account button on the top left. On Coinbase and Coinbase Pro all taxable transactional history can be recorded by third-party crypto tax calculating software automatically and on all exchanges. You can then trade multiple cryptocurrencies on a growing number of GBP markets which seem to have decent trading volume.

If youre wondering how much tax do you have to pay on crypto income in the uk the answer depends on your income tax band. No Coinbase doesnt provide a specific Coinbase tax report for all users. Cost Basis is the first estimation of an advantage for tax purposes.

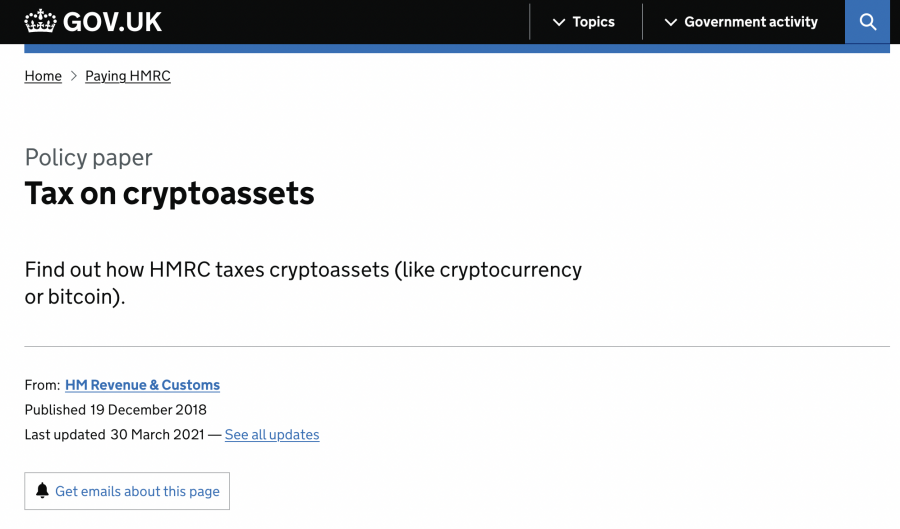

Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. Staying with our Coinbase models on the off chance that you paid 1000 to secure 01 Bitcoin on Coinbase your cost premise is 1000 for that Bitcoin. On the left-hand column under Wallet Balance select Deposit.

You then export your tax forms that can be added to your tax returns. Your first 12570 of income in the UK is tax free for the 20212022 tax year. This allowance was 12500 for the 20202021 tax year.

This matters for your crypto because you subtract. Open the trading view. The tax center will provide you with all of the taxable activity on Coinbase and tell you if you owe taxes and how much you have to pay.

Filing Taxes on Coinbase Pro Connecting your Coinbase Pro account to CoinTracker Visit Coinbase Pro API page Click New API Key Under Permissions select View Copy the Passphrase and paste into CoinTracker Leave the IP whitelist blank Click Create API Key If applicable enter your two-factor authentication code Click Add API Key. How to do your Coinbase Pro taxes Heres how you can include all of your Coinbase Pro transactions on your tax report within minutes. If you are buying or selling between 11 and 2649 the trading fee is 149.

Unofficial CoinbasePro dont give out your friggin personal info on here bud. Does Coinbase provide a tax statement. These plans range from 750 to 2500 per year depending on your number of transactions total asset value.

Coinbase pro taxes uk. To link your UK bank account follow these steps. Find Coinbase Pro in the list of supported exchanges and select the import method you prefer.

The easiest way to do this is using the Coinbase tax report API. Taxes are only paid on any gains not the full amount of the crypto held. In the realm of crypto your cost premise is basically the amount it cost you to gain the coin.

The Complete Coinbase Tax Reporting Guide Koinly

The Complete Coinbase Tax Reporting Guide Koinly

3 Steps To Calculate Coinbase Taxes 2022 Updated

K Quantstamp S Successful Security Audit Of Binance S Erc20 Tokens

Uk Cryptocurrency Tax Guide Cointracker

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Coinbase Debit Card Tax Guide Gordon Law Group

The Most Crypto Friendly Tax Countries Wanderers Wealth

3 Steps To Calculate Coinbase Taxes 2022 Updated

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

Uk Cryptocurrency Tax Guide Cointracker

The Complete Coinbase Tax Reporting Guide Koinly

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

Uk Cryptocurrency Tax Guide Cointracker

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Crypto Tax Uk Explained What You Pay On Crypto Gains In 2022

Uk Cryptocurrency Tax Guide Cointracker

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes